The emergence of Artificial Intelligence has eased the human lifestyle and day-to-day work. Within the giant sphere of Artificial Intelligence, finance is rapidly growing and advancing where the humans are getting benefits from it regularly. Be it corporations or banks; both are relying on AI to produce quality results. Thus, it becomes necessary to talk about what Artificial Intelligence in Finance can provide you.

5 Benefits of Artificial Intelligence in Finance

1. Fraud Detection and Management

With the progress of time, Banks are realising the usage of Artificial Intelligence for fraud detection is effective and efficient. Before that, fraud detection in banking and fintech was seen as challenging for analysts.

What is Fraud Detection?

Fraud Detection can be identified as a process to find fraudulent actions and scams obtained through false pretences. Online finance fraud is one of the largest scams running throughout the globe. It can undermine and shake the foundation of any business. (Advair Diskus) Thereby, it is necessary such acts are diagnosed at an early stage.

To rescue the industry, Artificial Intelligence is coming up with tremendous ways where banks and corporates can use them for fraud detection:

- Know Your Customer (KYC)

AI-backed KYC measures can virtually instantly do facial recognition, compare fingerprints, and validate ID and documentation. This practical tool successfully balances client convenience and security.

- Behavioural Analytics

Financial organisations must first comprehend typical client behaviour in order to detect fraud accurately. Banks can create and categorise consumers into various profiles using machine learning to sort through enormous volumes of data from previous financial and non-financial transactions.

For example, IBM’s behavioural analytics can understand and anticipate how people will behave in every aspect of an encounter. The information is used to create profiles that discuss each individual’s behaviours, vendor, record, and device. These profiles are regularly updated to account for perceptive traits that provide educated predictions about future behaviour.

- Fraud Investigation

It might take a long time to investigate and prove fraud accusations, so it’s crucial to equip agents with the right resources to work more quickly. Teams can prioritise and expedite investigations with the aid of this use of augmented intelligence.

2. Managing Finance

When it comes to managing finance, it may come as a challenging task as we are surrounded by so much work throughout the day. Thereby, Personalised Financial Management is a recent wallet system which aids consumers in understanding where their money is being invested.

Apart from that, Financial guidance via chatbots available 24/7 is making trends in the market. They can comprehend the customer’s intent and try to steer them in the appropriate route using cutting-edge NLP approaches. They could assist users with changing their passwords, checking their balances, scheduling transactions, etc. Additionally, these chatbots can frequently detect the customer’s emotions and modify their response accordingly. To address the issue as soon as possible and prevent further aggravation, it would make sense to connect the customer to a human adviser if they notice that they are incredibly furious. Smart chatbots’ expanding capabilities also make it possible to cut costs by lightening the load on call centres.

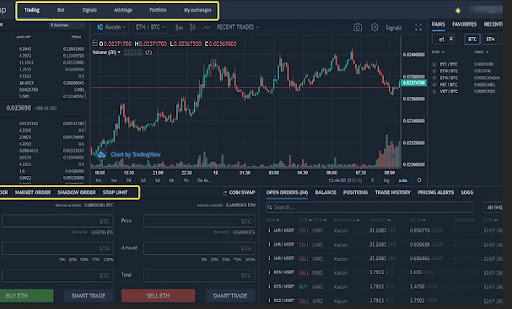

3. Algorithmic Trading

Investment firms have begun using computers and data scientists to predict future market trends. Trading and investing as a field rely on the capacity for precise future forecasting.

What is Algorithmic Trading?

Using automatic and pre-programmed trading instructions to execute orders while considering various factors, including volume, price, and time, is what algorithmic trading is all about. Nowadays, algorithmic trading uses sophisticated AI algorithms to generate between 50 and 70 per cent of trades on the equity market, 60 percent of deals on futures, and 50 percent on Treasury securities.

With the intersection of Algorithmic Trading and Artificial Intelligence in Finance, the business can experience benefits like:

- Elimination of Human Error.

Through this, errors based on emotional and psychological factors are reduced. Traders often make choices based on market pressures or fear of losing out, which leads to losses. However, with algorithm trading, the machine ensures that the order placement is done instantly and accurately.

According to a report by Mordor Intelligence, between 60 and 73% of all US equities trades were handled by AI-supported systems in 2020.

- Improved Accuracy

AI can provide portfolio solutions based on each person’s risk tolerance. Therefore, an individual with a high tolerance for risk can rely on AI to decide whether to buy, hold, or sell stock. When the market is predicted to collapse, those with a lower risk tolerance can sign up for notifications and decide whether to stay involved or exit the market.

AI-enhanced algorithmic trading is used to better serve target customers, including hedge funds, proprietary trading houses, corporates, bank proprietary trading desks, and next-generation marketing makers.

4. Credit Score

The most promising and applicable one is AI-based credit scoring. Credit scoring assesses a customer’s ability and willingness to pay back debt. There is an apparent demand for more intelligent credit scoring systems, given that there are 2.5 billion unbanked persons globally and that only around half of those who are banked are considered creditworthy.

Compared to earlier scoring systems, artificial intelligence enables a quicker and more precise evaluation of a possible borrower utilising more sophisticated techniques. Advanced classification algorithms are then used to arrive at the final score, determining whether the applicant will be granted the loan. These explanatory variables include demographic information, income, savings, past credit history, transaction history at the same institution, and many more.

5. Financial Robo-Advisory

A platform for managing your finances called a “Robo-advisor” features a machine learning algorithm is running in the background unattended. Using survey replies, which human advisers often administer, the advisor manages an investor’s account and transacts on their behalf.

Robo-advisors can currently handle tasks like retirement planning and investment selection. The majority of this software requires users to join up and respond to a quick survey about their current financial situation and future goals. The software then analyses the user’s current financial status as a result.

A few programmes suggest financial moves that boost a user’s wealth and might automatically invest or rebalance the user’s allocations. As a result, several applications can track the user’s spending based on the actions of their bank or credit accounts and suggest budgets.

According to Deloitte, these applications make wealth management so accessible that by 2025, the number of assets handled by these digital tools in the US alone might total $5 trillion to $7 trillion.

Conclusion on Artificial Intelligence in Finance

With the mentioned usage, one could predict the tsunami of growth and advancement that Artificial Intelligence in Finance will bring. Advancement in technology has eased lives across the globe, and its inclusion in Finance has made the life of users easy. It has simplified the complicated number process to methods any layman can follow, whether managing finance or algorithmic trading.

It can be said that while such options are available, it becomes necessary to educate consumers and save them from fraud and financial robbery.