Crypto market making is an important activity that increases the accessibility of cryptocurrencies to traders, investors and market participants around the world. It provides liquidity to a financial market, which is the degree to which an asset can be quickly bought or sold without significantly affecting its price.

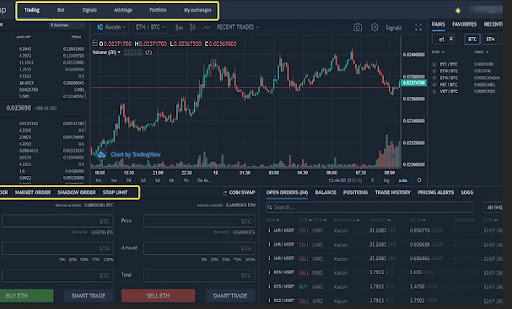

Crypto market makers are traders that simultaneously provide liquidity in a cryptocurrency exchange by buying and selling assets on the bid and ask sides of an asset pair. This allows traders to execute trades at the current market price and prevents wide spreads which negatively impact trading volumes.

While it might seem that crypto market making is a conflict of interest, it’s important to understand that an exchange and a market maker are two distinctly separate entities. While the latter can provide liquidity to an exchange, it doesn’t automatically mean that there is a conflict of interest.

Market makers are professional traders that operate under a license, provide liquidity on markets and earn from bid-ask spreads. They can be individuals or institutional players such as brokerage firms and hedge funds that have sufficient resources and expertise to provide the necessary liquidity for a crypto market.

However, with the advent of decentralized exchanges (DEX) that run on blockchains, crypto market making has evolved into an entirely different animal. These platforms have automated algorithms that control prices based on supply and demand and create liquidity pools where users can interact. In order to participate, all you need is a self-custody wallet and an internet connection. This approach reduces the cost barriers to entry for MMs as it eliminates the need for you to share your private keys with centralized entities or pay high fees to a broker firm.

In addition to providing liquidity, a crypto market maker can also take advantage of arbitrage opportunities by selling on one venue and buying on another to profit from pricing discrepancies (Two-Legged-Trading). As such, these strategies must be designed with risk management in mind.

Token projects should consider working with a market maker program that provides liquidity to the crypto markets while following robust risk management practices. This will enable them to offer a stable and welcoming environment for traders to buy and sell their tokens, regardless of the volatility and shifting market conditions. NinjaPromo, a digital marketing agency, offers market-making services for token projects that help them increase liquidity and maximize their potential for growth. This is accomplished by leveraging its unique set of skills, including digital marketing, software engineering, algorithmic trading, and rigorous human oversight to create the best possible outcome for each project.