A coin was very smartly designed by its architect. Its two sides were a reflection of everything in this world. It proves that nothing exists with only one side of advantages. There will always be a complimentary dark side of every new discovery in this world.

Technology is no different. Mobile phones were designed for our convenience, but their addiction has posed a plethora of problems in our lives. Automatic cars were developed for taking our world to another level, but many fatal accidents have been reported since people started using them. Even robots were made to help us in our daily lives, but artificial intelligence became a dangerous threat in their development.

Internet

And the most basic inventions: the computer and the internet brought a revolution with them in the whole world. Their usefulness and need is not debatable and does not need to be told. You are able to read this because of them. But their dark side is not hidden from the world anymore. With the escalated use of internet today, cyber crimes have become prominent worldwide.

The statistics of the cyber crimes in the UK over the past two years give a strong glimpse of how bad the situation is.

- In 2017, the UK reported 17 million cyber-crime victims, losing around £130 billion.

- Cyber-crime victims in the UK lose over £190,000 every day.

- People in the UK lost more than £6 million between October 2017 and March 2018 due to cyber frauds.

- From April to September 2018, the victims lost £6 million in cyber-crimes.

- 5 million cyber-crimes were reported in England and Wales alone, during the year ending March 2018.

Cyber Crimes

In a lay man definition, a cyber crime is a criminal offence that involves a computer. Though there are multiple ways of how it takes form, but the two broad categories are personal and business crimes.

- Personal – Hacking, Phishing, Stalking, Bullying, Social Engineering, Spamming, Hacking, Identity Theft, Malvertising, Key logging, Webcam Spying

- Business- Ransom ware, DDOS Attack, Botnets, Malicious Software

Personal cyber crimes usually target individuals. Downloading or clicking on a malicious link or software can trigger the download of a virus, thus making personal information and sensitive data of a person vulnerable to the attacker. Identity thefts and extortion cases are the most common attacks under this category.

Cyber crimes get more serious and dangerous when it comes to businesses and government organisations. The entire database of an institution is held at ransom by the hackers and exposed to the world or even deleted if their conditions are not met. (homefortheharvest.com) Over the years, many big companies and even government enterprises have faced cruel extortions by cyber criminals.

FinTech

The introduction of FinTech has been nothing less than a revolution around the world. It has decreased the dependency on banks and increased personal banking options for individuals. All financial services are now available online or through mobile phone applications. (Ambien)

Not just that, credit facilities have also witnessed an expansion with since the launch of unsecured lending industry. Where people faced difficulty in getting easy loan approvals, they are now able to get even loans for bad credit with no guarantor from British Lenders a direct lender in the UK. Bad credit scores also became less jinxed. All bank related services and credit needs of people have been much convenient and comfortable today, only due to the amalgamation of finance and technology.

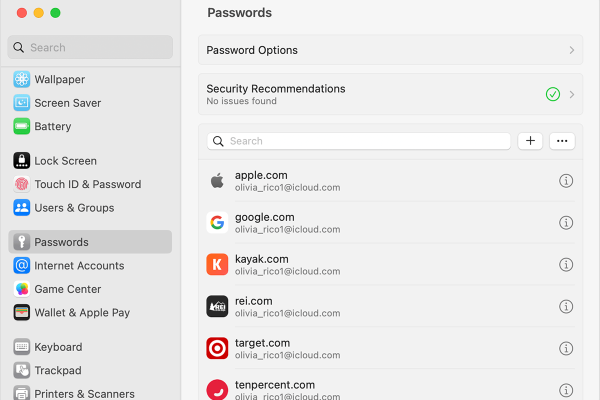

But there is always a rough side to a smooth one. While FinTech has made our lives much simpler, it has brought much vulnerability with itself. Accessing our bank accounts online has made them highly prone to cyber attacks. Viruses that store passwords and personal data can easily let a cyber criminal access our bank account and all our financial resources.

Not just that, spam messages and fraud websites can make us fall prey to trickery transactions resulting in loss of money. Dealing with money online while making online purchases or transactions needs to be done on a highly secured platform. With millions of e-commerce websites online, it becomes almost impossible to determine the reliability of a certain vendor. One that looks genuine can actually be a fraudster trying to get your money.

News

When you look online at the news results for cyber attacks in the UK, you are hit with alarming headlines on your screen.

- UK stung by 140% increase in cyber attacks. (consultancy.uk)

- 55% of the UK firms report cyber attacks. (independent online)

- Baltimore ransom ware attack cripples public services. (IT PRO)

- Cyber innovation at the forefront of UK’s approach to modern warfare. (gov.uk)

- Cyber attack on Sunderland City Council database. (Sunderland Echo)

And these are just the top ones. With people losing billions of pounds every year, it becomes very difficult to overcome the lost money.

Britons

With such high vulnerability and increase in magnitude, many citizens have lost millions of pounds collectively. In addition, there is no claim that can be filed for the recovery of such lost funds. This becomes difficult specifically for those households who have limited income coming in each month. Though there are cyber cells set up for reporting and investigating cyber crimes, the money (if it comes back) takes a while to reach back the victim.

For this period of financial shortage, we have to choice to opt for short-term loans online. These independent loans can be borrowed without the presence of a guarantor. Even our bad credit score does not pose a problem for getting an approval. For our short-term needs, till our salaries are credited, these unsecured loans are our aid.

It is not entirely our fault if we get trapped into losing money on the internet. Not each of one of us is computer expert to know the intricacies of the web. Neither can we undo once we have lost the money. All we can do is report the incident, borrow (usually from an online direct lender) money for our needs and move on with our lives: this time more carefully.